We relentlessly strive to understand how a changing world works: our investment process is based on bottoms up dynamic models that capture economic linkages, technology and social disruption, and structural market flows.

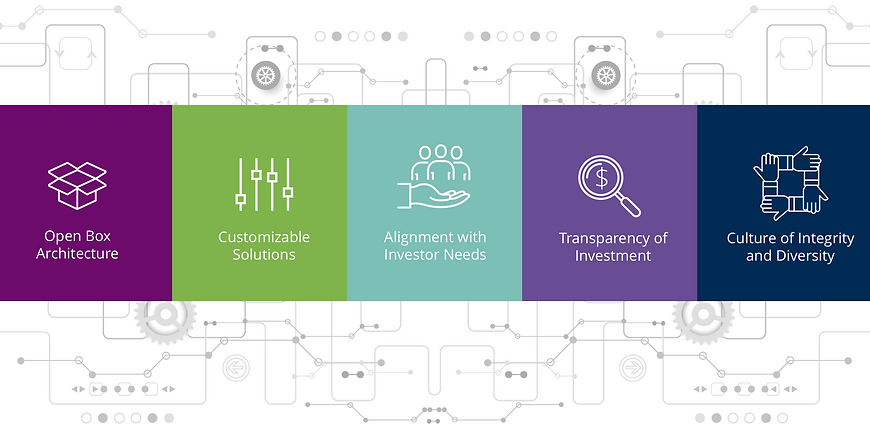

We formed a team of experienced investment professionals with state-of-the-art technology in an adaptable investment ecosystem.

Provide targeted exposure based on client objectives

Allocate risk to the highest confidence signals while limiting the downside

Provide targeted exposure based on client objectives

Our proprietary fundamental models identify the highest conviction investment ideas into a portfolio that is thematically balanced, protecting returns against tail risk.